Revolut Review: Is Revolut Safe For Travelling

/This post contains affiliate links, meaning that I earn a commission on each sale at no extra cost for you. The commission received helps to support this website and keep it ad-free. ;)

When it comes to finance, the millennial that I am likes everything to be handled quickly. I am still amazed that still today, when technology is booming, banks still rely on sending documentation by post!

In which way is that safer than doing it via Internet on a secure platform?

Banks still need to adapt their products and services to their clients whose lifestyle is changing quickly.

And only a few fintech companies have understood that need like Paypal, Transferwise, N26, Stripe and Revolut.

They pretty much offer the same kind of services with the advantage to deal with everything online.

I personally use Revolut as my go to service when it comes to traveling and here are the reasons why.

Revolut Smartphone application

It is free to join and you can access all the details of your card from the application. Their smartphone app is very well designed and very user friendly.

Just Download the app and register with your mobile number.

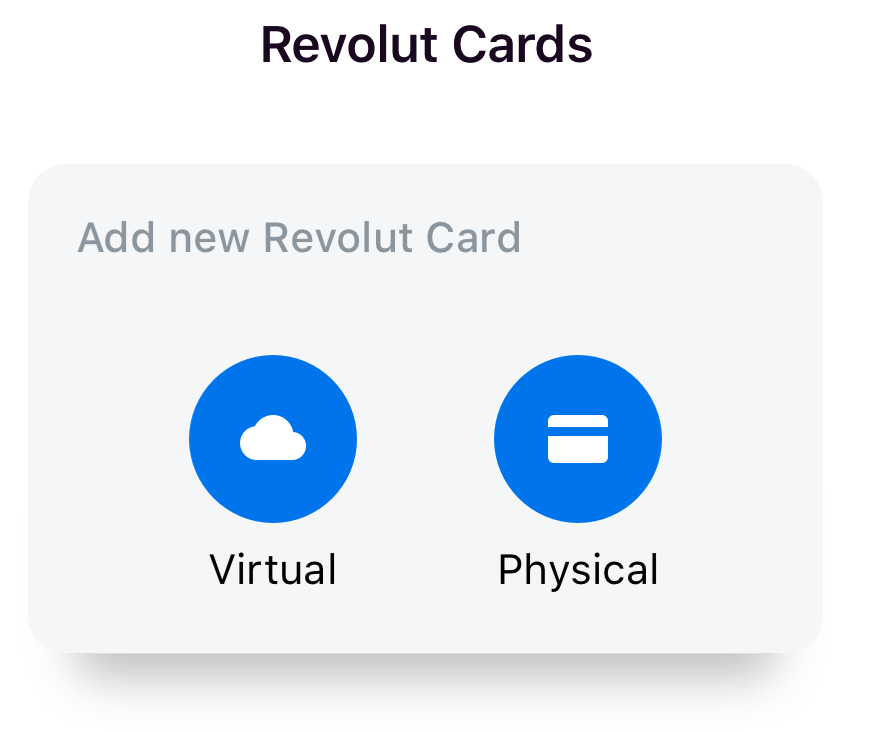

Instantly, you can see your Revolut card details you can use for online purchases or you can order the card to be delivered to your home address.

You also can access your PIN number from the app and can change it anytime you want to!

Online payments

Consider your Revolut card as a prepaid card.

It is linked to your local bank account where you store your money.

And you have two possibilities either use the Revolut card details that has been delivered to your home address or create a virtual one for free for your online payments.

All you need is to load the card with the amount of your choice.

I am sure we have all been victim of an online fraud once in our life, it happens to everyone.

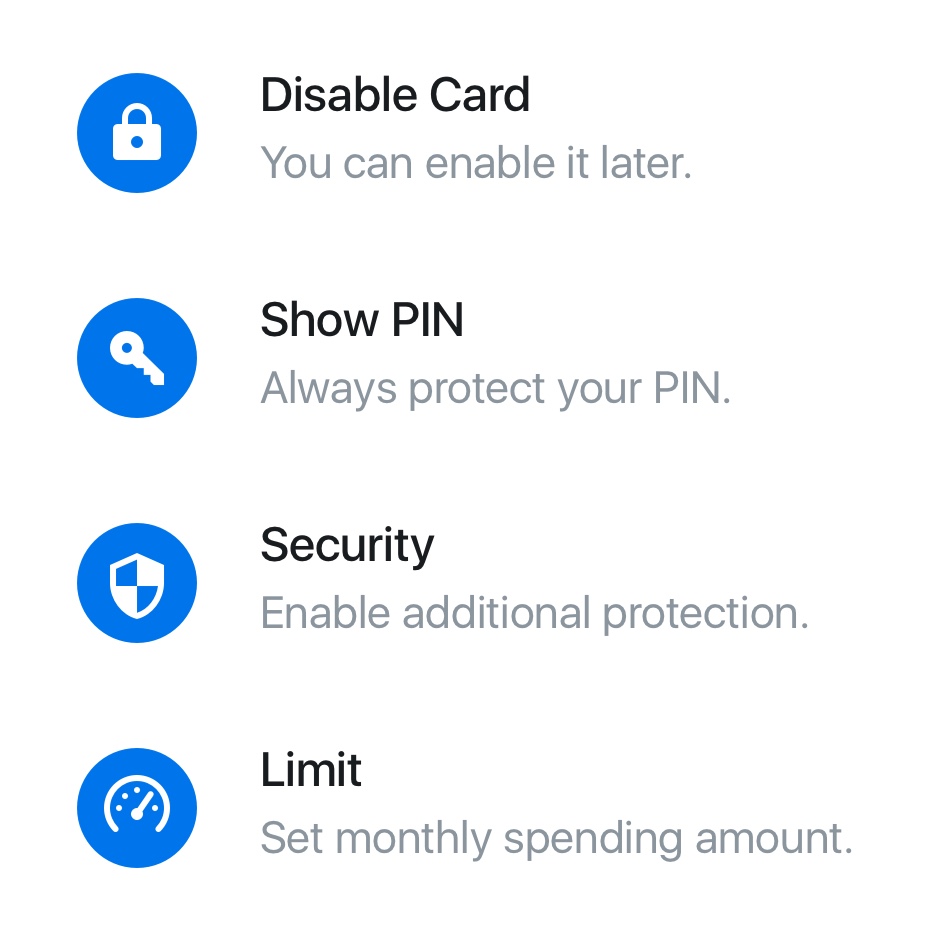

The good thing with Revolut is that you control how much money you want to put on the card and if you notice anything weird happening you can disable the card, transfer the money back to your home bank account until the situation is solved.

Your money remains safe in your bank account. Hence, the reasons not to put all your eggs in the same basket!

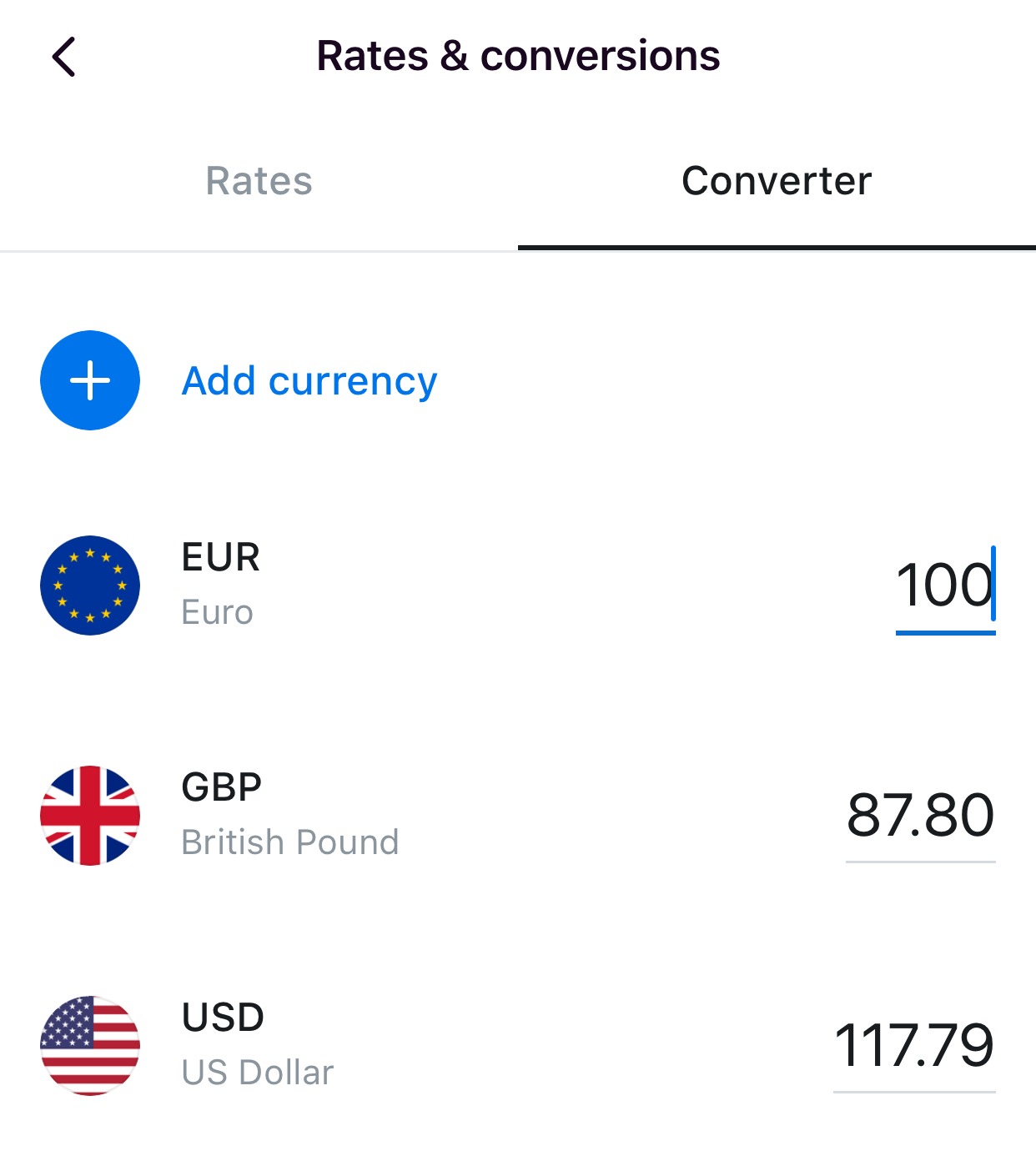

Always get real exchange rates

When I go abroad I transfer money to my Revolut account and pay everywhere with my card, it does not matter where I am.

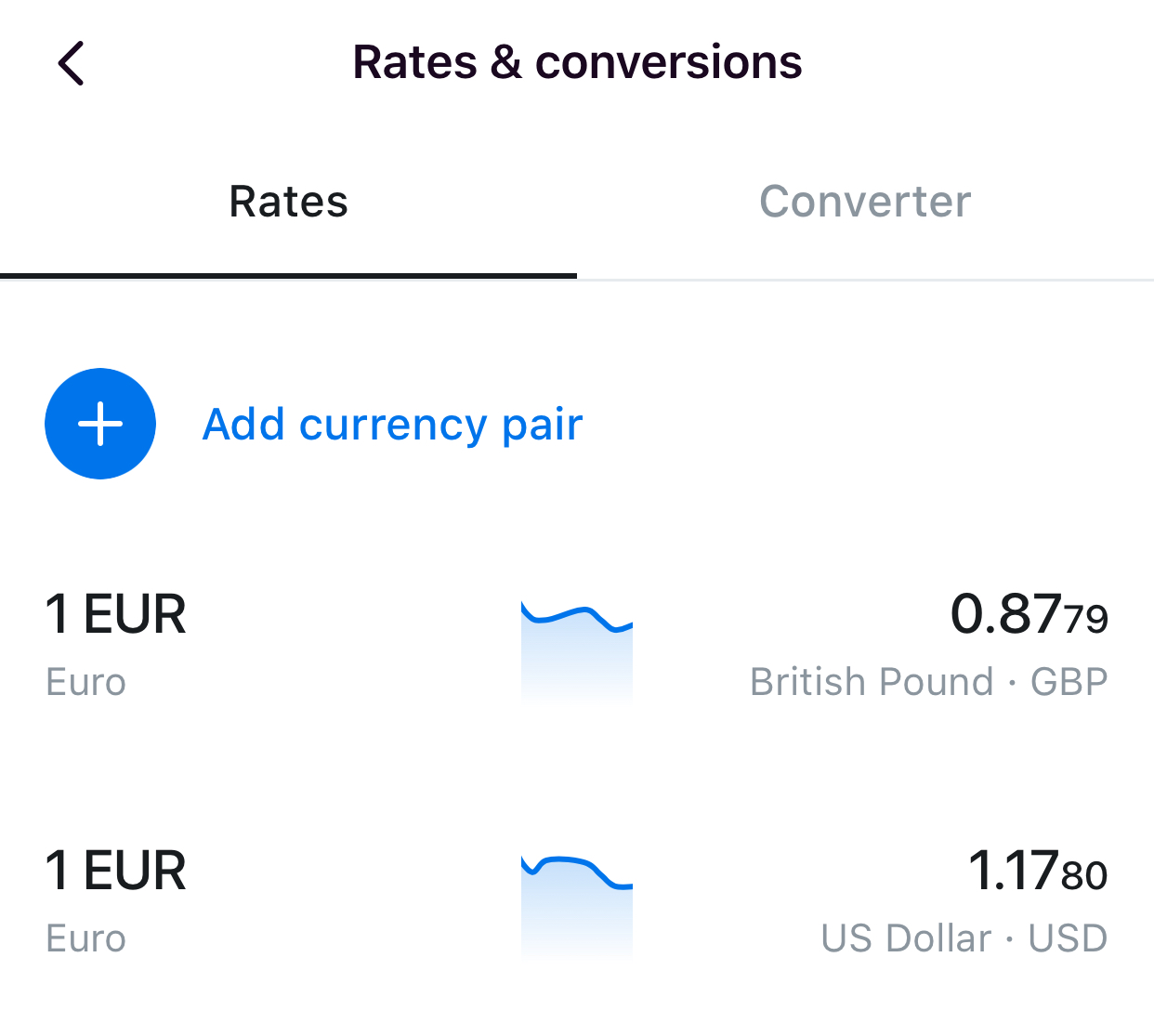

Wherever I am and for each transaction the Revolut app check my available balance and convert it to the local currency automatically at the best rate possible

I can also convert money in 3 currencies for no fees. No need to go through the hassle of an exchange bureau again.

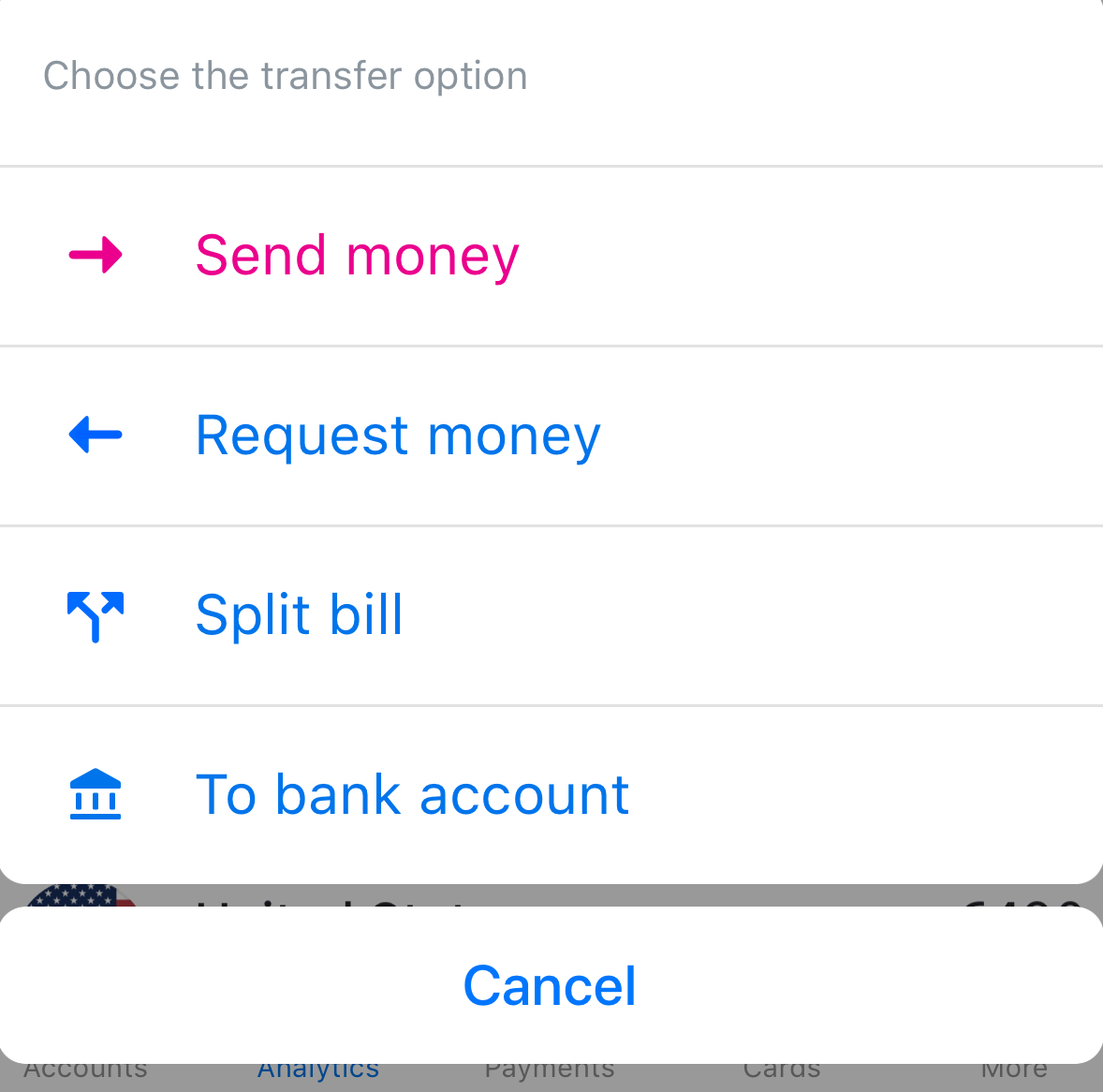

Send Money to friends and family instantly

If family and friends need to send me money from anywhere in the world. As long as they also use the Revolut app, I can receive the money instantly. Perfect when you forgot your wallet for instance or want to split the bill when you go out.

Link your Revolut Card To Apple pay

You can link your Revolut card to your phone wallet. I personally use Apple pay and this saved me from missing a flight once!

Indeed, I realised that I forgot my wallet at home while I was on the way to the airport to catch a flight taking off in couple of hours. If I decided to go back home to pick it up I’d have missed my flight. So, instead I asked several friends who used Revolut if they could lend me some money.

By the time I arrived at the airport my friends already sent me the money I needed for my trip. All happened in matter of minutes! And I was able to catch my flight with the peace of mind of not having any financial worry and be able to use my phone to pay for my transactions.

Transfer money globally

I can also setup money transfer to pay for my bills, loans and mortgages back home directly from the app in 26 currencies to any bank worldwide with the real exchange rate.

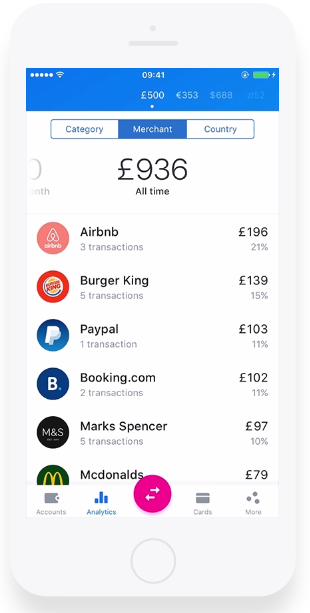

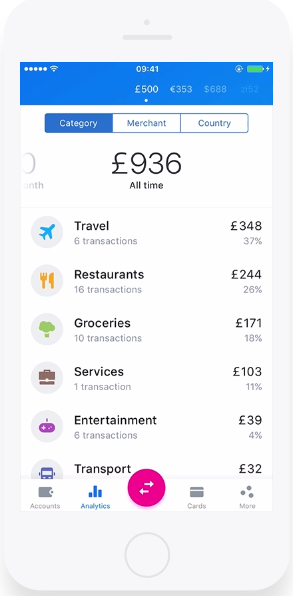

Track my expenses

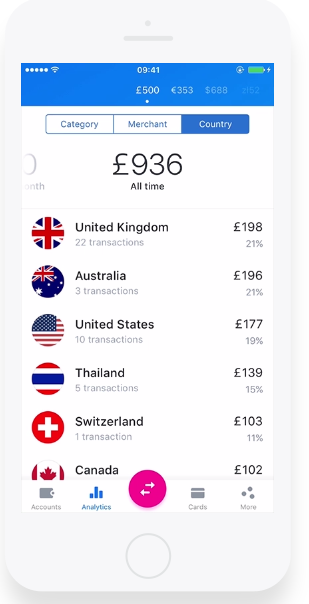

You receive a notification instantly on your phone for every transaction you made. The application also breaks down your expenses by categories, merchants and countries so that you can keep track of your budget.

Is Revolut Safe?

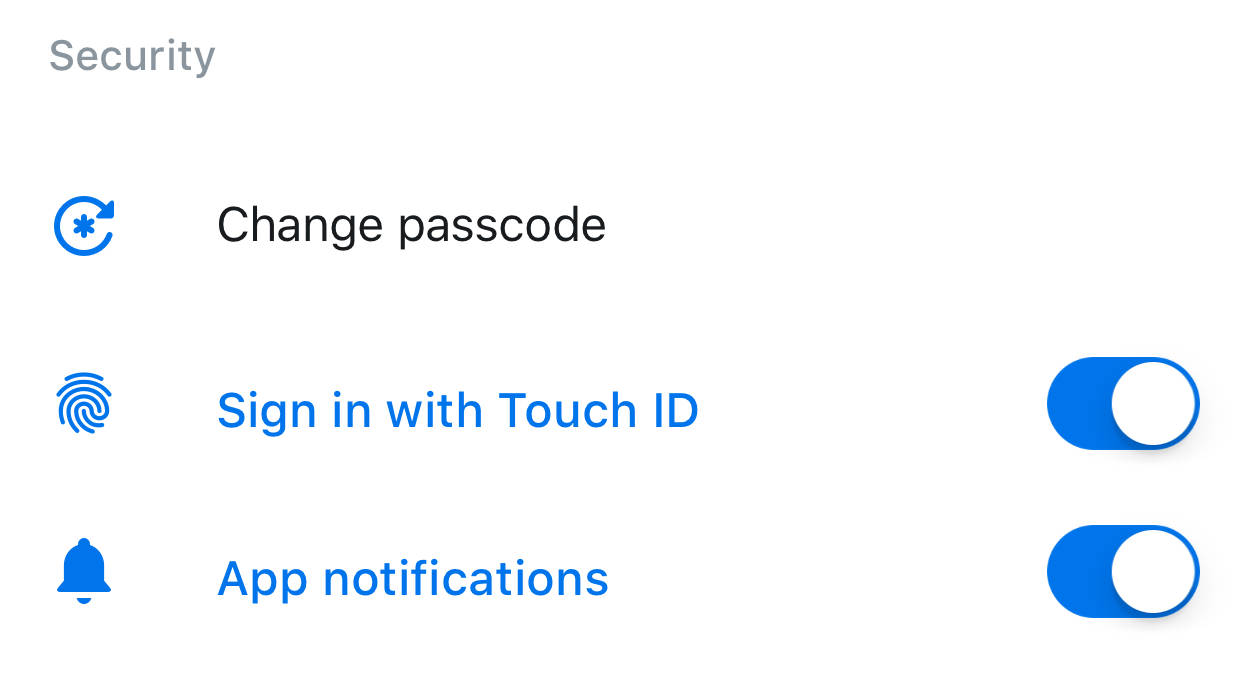

As I said earlier, it is very safe. Firstly, to access to the app you need to either enter the PIN code you setup when you created your account or use finger print recognition if you own a device with this feature available which I recommend, much safer.

You can also block and unblock your Revolut card in a single tap and turn online, ATM or contactless payments on and off instantly.

You are the one in control and no need to call any customer support. All you need is an internet connection.

Revolut Online customer service

Have any trouble with your card? Willing to know more about a new service available. Just use the chat section of the app to talk with their very responsive customer support.

Open a Revolut current account

Recently, they also offered the possibility to open a UK current account without a proof of address or credit check. Other countries are coming soon.

Open a Revolut business account

If you are a business, you can also apply for a business account which will get you the same benefits and allow you to track your business expenses for yourself and the rest of your team.

The only limitation in my case was that you cannot use it for car hire in most countries, you will need a credit card for the deposit authorization. There is also a limit on the amount of time you can withdraw money per month, otherwise a charge applies.

Pros And Cons Of Using The Revolut Card

Pros

easy money management via the application

apple pay.

fair exchange rates and spend money abroad with no worries of getting your card frozen by your bank

safe to use

Cons

No online access. you can only access the services via the application.

With the travel lifestyle I have adopted over the years, Revolut is the perfect financial companion wherever I go that removes all the hassle of dealing with a new currency when I travel abroad. And I believe this is what we need more and more in the society we live in today. We need banks to be able to provide services wherever we are, whenever we need and with the shortest turnaround time possible.

If like me you are traveling often and do not want to use your bank card or credit card, I highly recommend using their services!

Join me and over 15 million users who love Revolut. Sign up with my referral link here and see for yourself how convenient using this card is.

What about you? What travel cards have you been using to fit with your lifestyle?

If you enjoyed reading this blog post, make sure to like it, it makes a difference. If you’d like to receive more travel tips and resources I invite you to download a copy of my travel guide via the form below.

And if you know anyone that would benefit from reading this article, do not hesitate to share the word.